Analysys, the famous internet consulting firm in China issued an

analysis of Baidu today titled "Baidu needs to transform their traffic and the "targeting" of that traffic to capability of monetization".

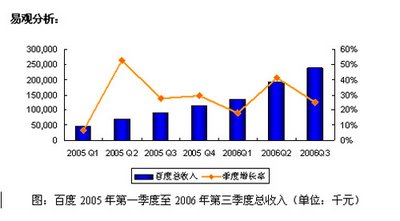

Baidu just issued unaudited financial result for the third quarter, ending Sept. 30, 2006. The report shows Baidu's third quarter revenue totaled $30.3 million, increasing 24.9% quarter over quarter and 169.1% over same period last year. Net income came in at $10.8 million, increasing 45.8% over last quarter and 902.5% over same period of last year.

Analysys's Analysis:

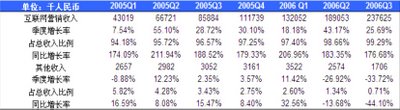

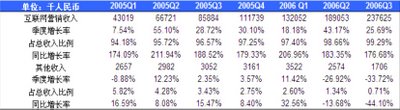

(Note: Row 1-search marketing revenue; Row 2-Q/Q growth rate; Row 3-ratio in total revenue;

Row 4 year/year growth rate; The rest data are from other income which are much less significant.)

Baidu's total revenue for the quarter reached 229.3 million yuan, increasing 24.89% quarter over quarter, and 169.1% year over year. After Baidu cut it's ERP software division, the percentage of search marketing revenue reached 99.29% of total revenue 237 million yuan.(Note: Analysys switched the two numbers probably by mistake).

Analysys thinks the following three events are worthy to watch carefully:

1. Baidu introduced some improvement in search ranking since Sept. 11 by adding "composite ranking index". Analysys thinks, most questions posted by customers are focused on "invalid clicks" and the implication on higher payment. Since the basic question is the justification of the result of search marketing, the "composite ranking index" does not remove all the doubts from customers. It may affect the degree of satisfaction for a couple of quarters, especially those websites heavily dependent on search engine for their online sales. That could impact Baidu's revenue.

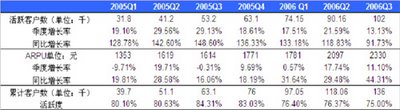

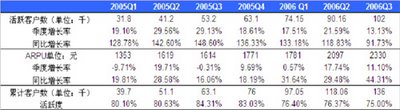

2. During the third quarter, 2006, Baidu replaced channel resellers in Beijing region with direct sales force to strengthen competitiveness in the critical regions. Baidu's active customers reached 102,000, increasing 91.73% year over year. The growth rate slowed. Average consumption per customer increased 11.1% to reach 2,330 yuan. Analysys thinks the direct sales strategy in the largest cities such as Beijing and Shanghai is for increasing penetration in the big advertisers. The transformation from channel partners to direct sales will certainly increase the satisfaction of customers. However, the direct sales force needs time for the transformation and follow up on customers, the number of active customers could be impacted.

(note, Row 1- number of active customers in thousand; Row 2-Q/Q growth rate; Row 3-year/year growth rate; Row 4- ARPU in Yuan; Row 5-Q/Q; Row 6-year/year; Row 7-accumulated number of customers; Row 8-ration of active customer/total customer)

3. Baidu announced in the quarter, that they have formed alliance with Viacom's MTV unit. A new MTV special zone will be placed inside Baidu's video search. Four of Viacom's Chinese partners will also join the service. Viacom will supply the original contents and Baidu will provide the platform and communication channel. Users will be able to watch the shows free or pay a fee to download. The monetization will mainly come from advertising. Analysys thinks the collaboration should be further expanded to internet blogs and personal web pages to explore the market opportunities in personal purchasing and short term consumption of videos. To expand monetization, Baidu needs to further improve functionality and service.

Analysys opinion

Analysys thinks, the "over exploration" on search marketing has led to the increased ratio of inactive customers. Baidu must look for new source of revenue besides improving services and cultivating the market. Analysys thinks, due to the conservative "follower" strategy in expanding new business opportunities, Baidu has lost significant chances in areas of new web applications, mobile value-added services. Baidu needs to transform their traffic and the "targeting" of the traffic to capability of monetization.

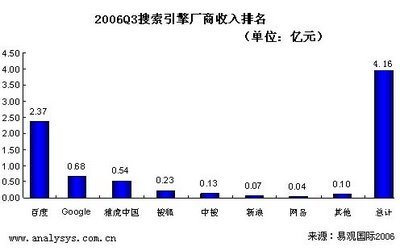

Google's revenue reached 68 million yuan, up 11% from last quarter's 61 million. Yahoo did not do well, with revenue falling to 54 million from 59 million yuan last quarter.

Google's revenue reached 68 million yuan, up 11% from last quarter's 61 million. Yahoo did not do well, with revenue falling to 54 million from 59 million yuan last quarter.

Google's revenue reached 68 million yuan, up 11% from last quarter's 61 million. Yahoo did not do well, with revenue falling to 54 million from 59 million yuan last quarter.

Google's revenue reached 68 million yuan, up 11% from last quarter's 61 million. Yahoo did not do well, with revenue falling to 54 million from 59 million yuan last quarter.